The cryptocurrency market is infamous for its volatility — prices swing wildly, driven by emotions like fear and greed. The Crypto Fear & Greed Index is a tool that captures these emotions, giving investors insight into the market’s mood. Let’s dive into what it is, how it works, and why it matters.

What is the Crypto Fear & Greed Index?

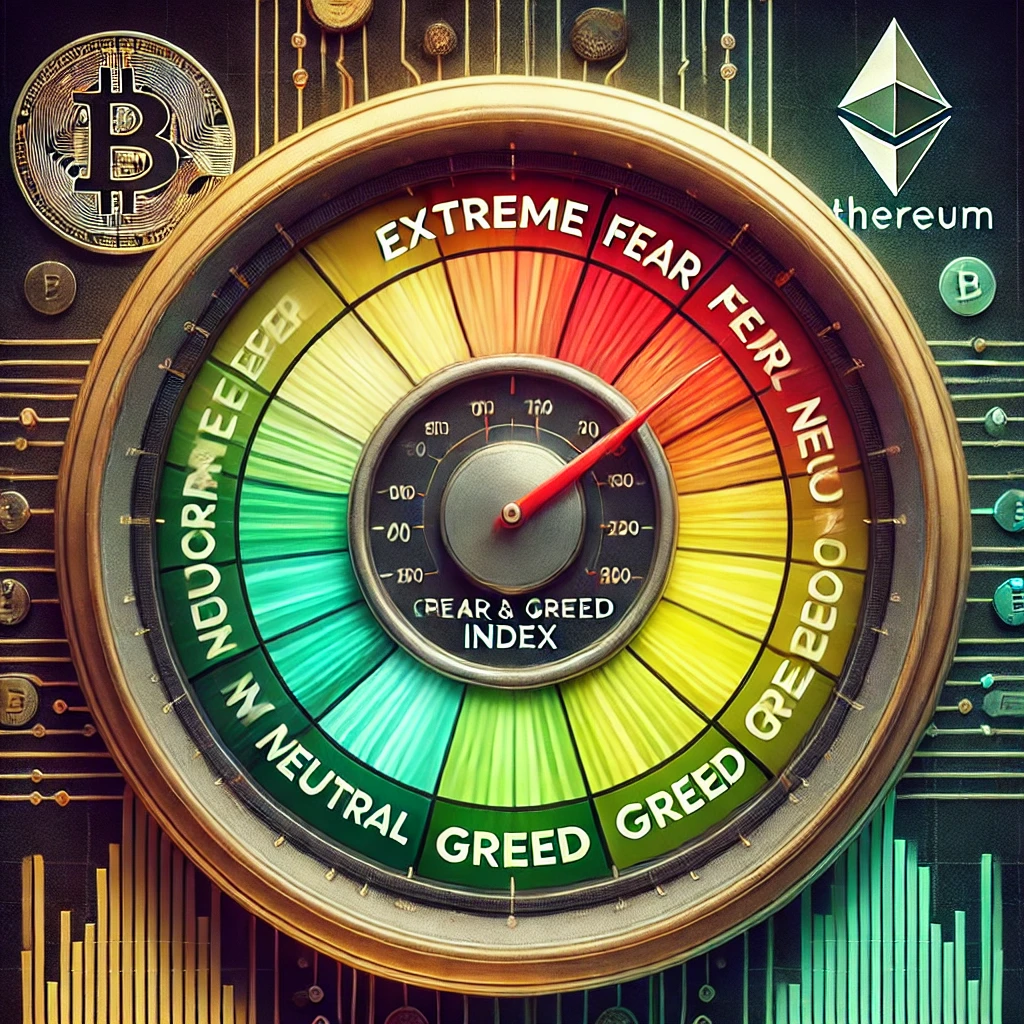

The index analyzes various factors to measure the overall sentiment of the crypto market on a scale from 0 to 100:

- 0-24: Extreme Fear (Red) — The market is fearful, often signaling a buying opportunity.

- 25-49: Fear (Orange) — Still cautious but less severe.

- 50: Neutral (Yellow) — Balanced sentiment, no strong emotion.

- 51-74: Greed (Light Green) — Market is getting optimistic, prices may rise.

- 75-100: Extreme Greed (Dark Green) — Overconfidence, a potential sign of an upcoming correction.

How is it Calculated?

The index combines several data points:

- Volatility (25%) — Sudden price swings increase fear.

- Market Momentum/Volume (25%) — Rising volumes and bullish trends suggest greed.

- Social Media (15%) — Mentions, hashtags, and engagement reflect sentiment.

- Surveys (15%) — Community polling (though less frequent).

- Bitcoin Dominance (10%) — A rising BTC dominance signals fear (flight to safety), while a decrease suggests more appetite for altcoins.

- Google Trends (10%) — Rising searches for “Bitcoin crash” indicate fear.

Why Should You Care?

The index helps traders avoid emotional decisions. For example:

- Extreme Fear: Could indicate an oversold market — a buying opportunity.

- Extreme Greed: Might mean the market is overheated — time to consider taking profits.

However, it’s crucial to combine the index with other research. Emotions don’t always reflect fundamentals, and the market can stay irrational longer than you expect.

Would you like to dive into how this index compares to traditional market indicators or how to integrate it into your trading strategy?

Great